Energy storage installations rise 61% this year

Source:pv magazine

While battery manufacturers have faced tough times in 2024, the sun is shining on the stationary storage market, finds BloombergNEF.

The Tamaya BESS will feature 152 battery containers from Sungrow

Image: Engie

Battery makers and cell manufacturers have faced a tough 2024 thus far, with falling margins and revenues due to slower-than-expected worldwide sales of electric vehicles (EVs), reducing volumes.

However, BloombergNEF (BNEF) reports that the stationary storage market has risen 61%, and prices for turnkey systems are down 43% from 2023, which is part of driving that deployment. In April, the figure was at a record low of $115/kWh for two-hour energy storage systems.

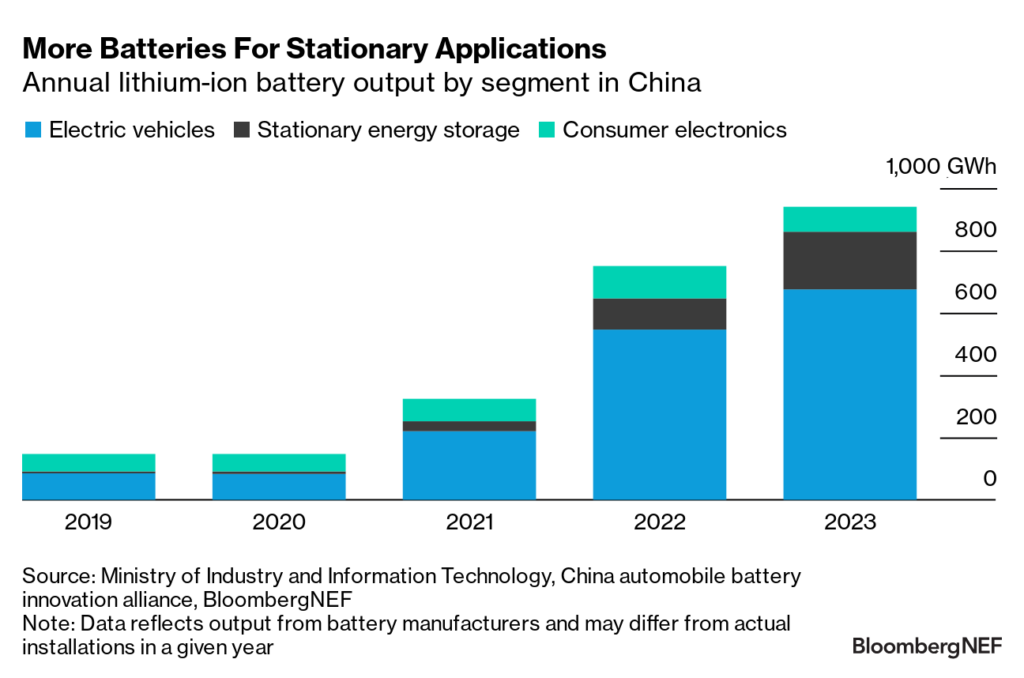

By looking at the annual lithium-ion battery output from Chinese manufacturers and assigning them an application, stationary energy storage overtook consumer electronics as the second-largest application for battery production. The global stationary energy storage market almost tripled in 2023.

Even combined, both were a long distance behind EVs. However, BNEF points out that the ratio of EV battery demand to stationary battery demand has fallen from 15-to-1 to 6-to-1 over the last four years:

Growth in the segment is much faster than EV battery growth, though, from a smaller base, and forecasted demand shows the segment continues to grow rapidly. That’s partly due to mandates in China for co-location with solar and wind for storage, plus the US Inflation Reduction Act, and measures rolling out in Europe, Japan, and Latin America, among others. Germany and Italy lead the residential market.

Regarding chemistry, BNEF expects NMC to hold a market share of only around 1% by 2030, as cheaper and potentially safer LFP chemistry takes market share.